Capital Markets Trading

- Upmood

- Jan 21

- 3 min read

2023

The Psychology of Profit: Decoding the Impact of Stress and Emotion on Hedge Fund Performance

No. of Participants: | 2 Traders |

Nature of Event: | Pilot Study |

Products Used: | Upmood Band, Upmood App, Upmood Insight |

Metrics Collected: | Stress level, Mood, HRV, BPM |

EIO Fund is a forward-thinking financial organization focused on optimizing investment strategies and portfolio management. In the high-stakes world of finance, decision-making is often assumed to be purely rational, yet human psychology plays a critical role. In March 2023, the EIO fund partnered with Upmood to conduct a pilot study investigating the direct correlation between a trader's emotional state and the fund’s PnL (Profit and Loss).

The goal was to analyze trading psychology, specifically how stress levels and emotional responses to market fluctuations influence a trader's willingness to buy or sell. By understanding how traders interpret and react to financial news and information flow, the firm aimed to uncover how emotion impacts the daily fluctuation of portfolio value.

Monitoring the Trading Floor

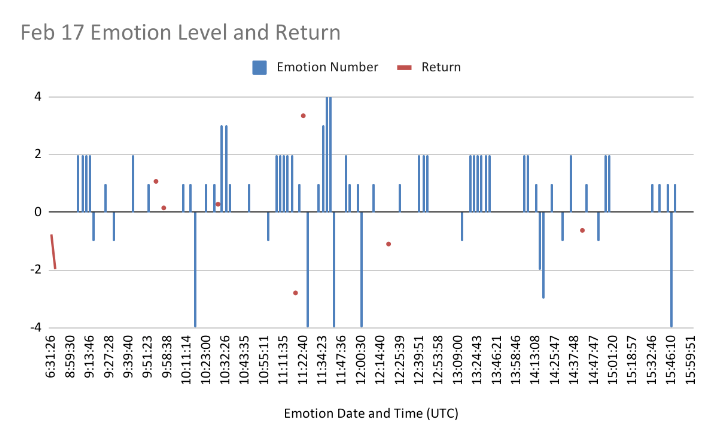

The pilot study focused on two professional traders during active market hours. As they navigated complex trading events and processed real-time media and financial news, Upmood wearables monitored their physiological signals continuously. The study sought to capture the visceral, physical reaction to market volatility—specifically, how the influx of information changed the traders' internal states. By time-stamping emotional data against trading logs and news releases, the team could map specific market events to corresponding shifts in the traders' stress and mood.

Why Upmood?

To quantify trading psychology without disrupting the workflow, the research team used Upmood’s ability to discreetly measure the physiological drivers of decision-making. In a fast-paced trading environment, stopping to fill out surveys is impossible. Upmood provided continuous, passive monitoring of Heart Rate Variability (HRV), which served as a reliable biomarker for stress and emotional arousal. This allowed researchers to objectively assess "Trading Psychology" without disrupting the traders' workflow. The granular data provided by Upmood Insight allowed the firm to correlate specific physiological spikes with the exact moments a trade was executed or a headline was read.

Key Outcomes and Results

The pilot provided fascinating insights into the human element of algorithmic trading environments:

😧Correlation of Stress and PnL: The study established a visible link between high-stress biomarkers and periods of significant PnL fluctuation, highlighting the physical cost of volatility.

📈News Impact Analysis: Data revealed how specific types of financial news triggered immediate emotional responses, influencing the traders' interpretation of the market before a decision was even made.

😌Behavioral Insights: The project offered a deeper understanding of how emotional states affect the "willingness to buy or sell," providing data that can be used to improve risk management protocols.

📈Optimized Performance: By identifying stress triggers, the fund gained preliminary data on how to help traders maintain an optimal psychological state for decision-making.

Conclusion

This collaboration with EIO fund highlighted the critical importance of emotional intelligence in the financial sector. By using Upmood to quantify trading psychology, the pilot demonstrated that understanding the "human factor" is key to understanding market performance. This partnership showcases how Upmood can help financial institutions and trading firms enhance performance, manage risk, and support the well-being of their traders through data-driven emotional insights.

Thank you!

We extend our sincere thanks to EIO fund and the participating traders for their openness to exploring the innovative intersection of biometrics and finance.

If you're interested in conducting your own case study or trying out Upmood products, please send us an email at support@upmood.com